One of the key differentiating aspects between companies that survive, and companies that thrive, is that leading companies keep a sharp eye on their competitors and market. Popularly known as competitor and market intelligence, these studies not only help thwart or pre-empt competitor moves, but can also help identify disrupting patterns in the market early on.

A significant portion of market and competitive intelligence data is built on text. Among that, most of it comes from free and open exchange of information captured by online mediums. A couple of decades ago, conferences and summits were more important than they currently are, because they were prime source of information exchange and corporate intelligence collection. While still relevant, the fact is that when it comes to market and competition intelligence, you can build an amazing and comprehensive picture from information on the web.

And Generative AI makes it possible to do that, without deploying a team of resources that can use their smart brains elsewhere.

And the model can update those reports on a daily basis.

There is still some groundwork that you need to do. Let us use the example of competitive intelligence. You will generally identify few competitors. Let us say you are a Pharma company, looking to find competitive intelligence on your key competitor Acme Inc. Like many other instances or possible use cases of GenAI, you can’t use GenAI unless you formulate a solution.

In this case, you need to define what elements of information available can be considered relevant, and within those relevant buckets, what type of information will be considered relevant. Hence, this initial solution will obviously differ from one industry to another and one company to another. But the gist is, once you have this initial blueprint defined, building a GenAI model to extract and build a report is not difficult.

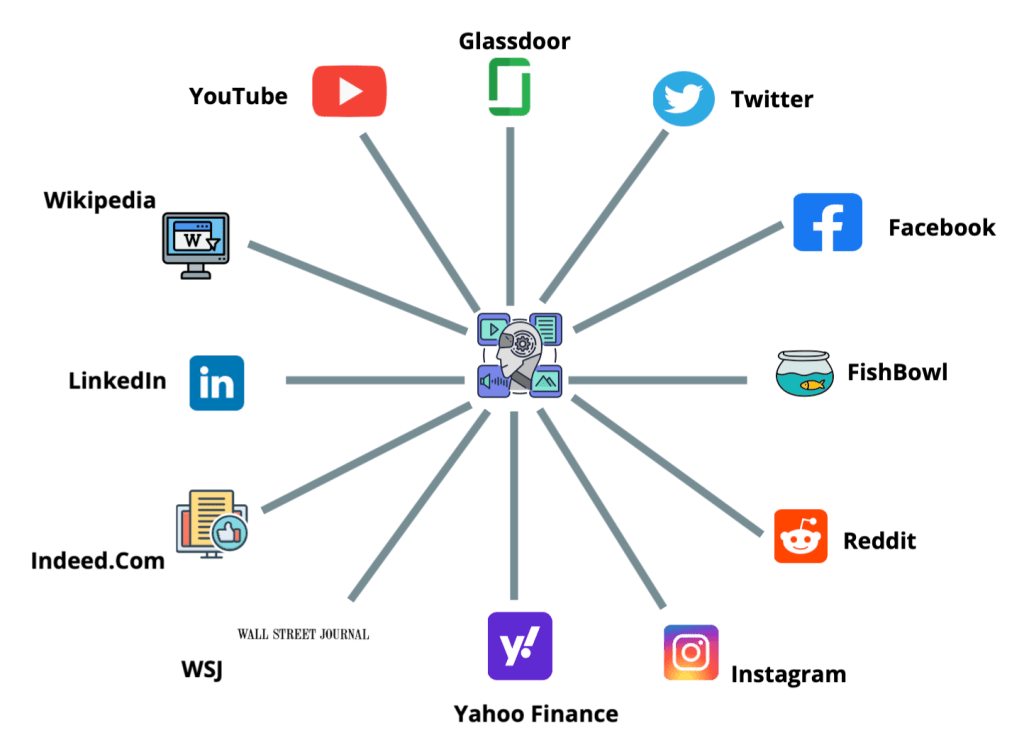

The illustration below, though not comprehensive, is a good overview of a variety of sources that need to be leveraged by the model to build the report. The SLM for this task can be built by companies themselves, which can ensure that there will be minimal or no challenge of hallucination, considering the limited scope of the model.

The sources highlighted in the illustration above is indicative but illustrates the categories of sources you need to tap. There can also be paid data sources that you can scrape. But the key to this type of a solution will be identifying these sources, then defining the “intelligence” components. If done prudently, the accuracy is guaranteed.