Last week, we learned that Apple will allow used parts to be used in repairing iPhones. This news is important and has been hailed as a move that will help reduce the environmental impact of phone upgrades and replacements. That certainly is a major impact on this move. But let us analyze this decision from a strategic perspective. If you missed this news, read about it here: Apple to expand repair options with support for used genuine parts.

Under the current circumstances, Apple needs to expand its iPhone user base in emerging markets. One critical bottleneck has always been affordability. For the last few years, Apple has been trying to ramp up its market share for used phones in these emerging markets. While the strategy has not been explicitly discussed, I think it is to get more and more of the smartphone user base in these countries familiar with Apple’s eco-system. The revenue/profit aspect, if any, is secondary.

Once users start enjoying the ecosystem, the probability of upgrading to a new model increases. Otherwise, because of the price point of a new iPhone, a significant percentage of users in these potential emerging markets will never get to experience what IOS and Apple ecosystem has to offer.

This move to allow used parts for repairs will increase the available inventory of used iPhones and their affordability. An iPhone that has been refurbished using a certified used part will, under most circumstances, be cheaper than one with a new part for the same year and trim (assuming the cosmetic condition is also similar).

But this is where there is a catch. There is a line, that Apple can not cross when it comes to the affordability of its phones.

The reason behind that is Apple’s brand positioning.

Apple smartphones have always been viewed as offering a niche product in the now-crowded smartphone market (in emerging markets). You can categorize Apple’s offerings in some markets as “luxury goods.” So, if a used iPhone becomes as affordable as a new Galaxy A56, Apple may have pushed the quest too far. It can undermine the basic premises of its entire iPhone range positioning in these markets . The good news is that Apple can use analytics to understand how far it can push the affordability line, beyond which its products, iPhones, in this case, will start deviating from luxury to commodity.

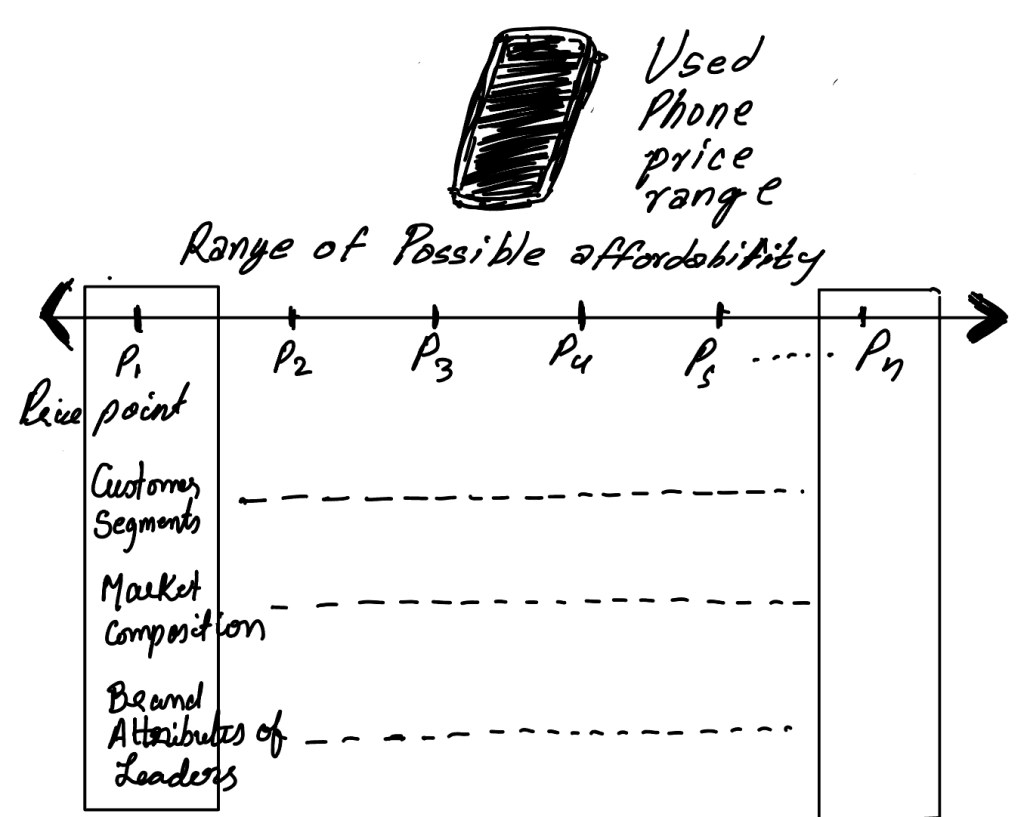

The high-level structure of this problem is simple. Using prediction models and market research data, you can build a model to understand how the phones will penetrate a specific market, for different segment groups, and for specific price ranges.

For each of these segments, you should also have data on the current segment leader’s brand positioning and the customer perception of that current leader. One of the key steps is forming the customer segments for each possible price point. Consider this example. The market is India, and your price point is 50,000 INR. There will be a customer segment that will be willing to spend 50,000-60,000 INR on an Oppo gaming phone rather than a used iPhone, even if it is available for 50.000 INR. Hence, careful segmentation and shortlisting of relevant segments for analysis is critical. And data forms the foundation for this segmentation exercise.

From this point, the strategic analytics aspect comes into play. You need to identify the segments where you do not want to be the market leader based on the branding of the current market leader. There is some analytics involved in this strategic analysis stage as well, but you get the point of the steps of this analysis. The gist is that making iPhones more affordable is not a straightforward strategy.

Apple is at a unique crossroads, and any wrong move it makes might take it on the path that Cisco took over a decade ago.