If you have watched the Hollywood movie Constantine, you may remember a scene in which a priest scans through newspapers by touching them to find news articles that are “relevant.” In the movie, he can do this because he has a gift. For humans, this feat is impossible unless they have been gifted with such power, but back in 2005, even envisioning a technology tool that could do something similar was out of the question. Now, we do have technology capabilities that can perform something like this. But what does this have to do with strategic analytics? Hold on to this question for a few minutes, and keep reading.

My wife returned from a month-long trip to India yesterday, and I am bombarded with stories and experiences from her trip. During one of the conversations, she mentioned IKEA, which caught my attention. Somehow, I missed the news that IKEA has forayed into India. To me, this idea seemed absurd as soon as I heard it. Why? IKEA has an amazingly successful model that has been replicated across countries and continents. So why is IKEA trying to establish itself in India an absurd move?

To do so, you first have to understand the mindset and behavior of the Indian consumer. Then, understand the specific industry. Then, the macro and micro aspects of the Indian economy. And then put it all together. The analysis can be comprehensive, but here are a few pointers that came to my mind immediately, making me think about the idea’s absurdity.

First, upper-middle-class Indians dislike assembling their own furniture, which is the core market that IKEA needs to tap to generate volume. But neither do Americans, you would say. You may be right; but remember that an American must pay $50-$150 to install the furniture if they do not want to assemble it themselves. Hence, they would love to buy furniture they can quickly assemble.

In the Indian perspective, if you can afford an Oxberg bookcase worth INR 25K, you can easily afford INR 500 to assemble it. So, ease of installation is not the criterion for furniture buying decisions. For errand-type tasks, labor is very cheap in India compared to the U.S.

Then, there is extreme fragmentation in the home furnishing industry in India, with millions of manufacturers of all sizes. That means (and you can validate this online; I did!) you can buy a product that looks exactly like the Oxberg bookcase, with the same quality, built, delivered, and installed, for under INR 10K. As Uber CEO highlighted correctly: “Indians do not want to pay for anything”. And for a piece of furniture, the upper middle class in India will certainly not pay more than double the price.

It is not just buying behavior and the options. The behavior of the consumer segment also comes into play. Indians will drive hours to spend with friends and family in a mall or window shop retail outlet’s food court but will not drive an hour just to buy furniture. Not when they can buy the same product minutes from home.

Needless to say, when I researched, it was evident that IKEA India has been incurring losses year after year. Sales are growing, which will naturally increase as IKEA opens more locations. But no matter how much it labels these losses as “investment,” the fact is that with the current model, it will not make a profit in India for years to come. Someone gave IKEA terrible advice. This was definitely not the right approach to entering the Indian market. Entering the market was a good idea, but the business model to enter with was not.

You are probably wondering, at this point-the guy started with a Hollywood movie and then has been ranting about IKEA. What is the point of all this? Let me put the pieces together now.

The core theme here is bad advice, and how deep learning tools can help bring more science to strategic analytics.

In the IKEA example, I touched upon three aspects:

- Consumer behavior

- Economic indicators

- Market data

While these three are not the only three aspects that should determine a market entry strategy, let us consider market entry strategy planning from this perspective. Market entry strategy planning should ideally start with insights supported by data pertaining to the areas identified above. Until recently, the quest to collect data for such analysis was manual, and then humans interpreted it to generate initial, starting-point insights. LLM models have already brought a whole new level of capability to conducting this type of research. However, the GPTs that we are currently familiar with, are not yet reliable enough to base important strategic insights on.

But we can develop one that is.

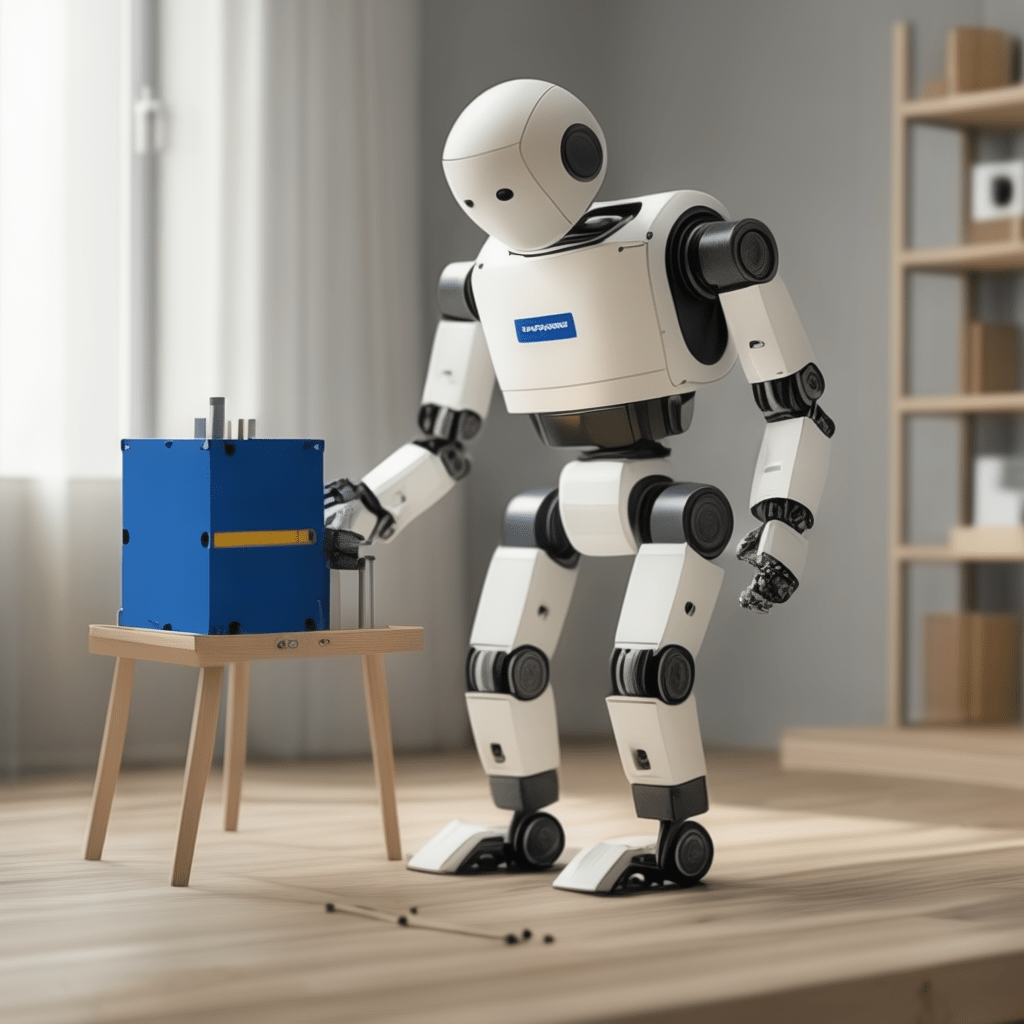

With time and resources, you can build a deep learning-based model with ten times the power of the priest in the movie Constantine. The model can do all the tasks that we touched upon, like understanding the mindset and behavior of the consumer. Understanding a specific industry. Understanding the macro and micro aspects of an economy. And then put it all together.

You can not only perform a massive search, the likes of which are not manually possible, but also translate that into critical insights into relevant areas. These models can be task-specific. For example, if you develop and train one for market analysis, you can shorten the time to perform this strategic analysis to days. You also eliminate human bias and distortion, like aligning results with stakeholders’ expectations, even if the results are unfavorable.

Let us revisit the IKEA example.

Leveraging an LLM, in conjunction with a couple of bolt-on deep learning-based algorithms, all you will need to do is provide inputs into text-based drop-down fields on what type of strategy you envision entering a specific market with. The algorithm can then translate your inputs into a research task for the LLM, with particular directions on information to research. Then, another algorithm interprets the output to perform a “strategy fit analysis.” All this is easily doable with our current technology capabilities, thereby transforming the approach of strategic planning and analytics.

The best candidates to develop these tools will be third-party companies that can offer these tools to various companies across industries. Companies would love to pay for such clarity, visibility into the critical data and insights behind recommendations and the ability to understand each and every aspect of insights and the data that supports it. Otherwise, they may be stuck like IKEA is stuck in India, trying to justify a bad move with business jargon kabuki dance.