Even before Covid came into the picture, an emerging technology had already created a platform for disrupting the globalization of manufacturing. The technology is 3D Printing.

Originally developed as an automated method for creating product prototypes, 3D Printing can significantly disrupt the supply chain by automating a significant proportion of manufacturing, eliminating the need for parts suppliers, and possibly reversing the trend of manufacturing globalization.

However, the adoption of this technology has been slower than expected, one of the primary drivers being the high cost per part for parts manufactured. With advances in this technology happening daily, the price will soon go low enough to justify the use of this technology since companies will also be able to get rid of the massive amount of inventory they need to hold due to long lead times. The other obvious benefit is eliminating freight costs for moving parts from overseas.

In this article, we will review the different stages of evolution of the disruption 3D printing or additive manufacturing can bring to the supply chain networks using a generic supply chain network example.

Supply Chain transformation from 3D Printing

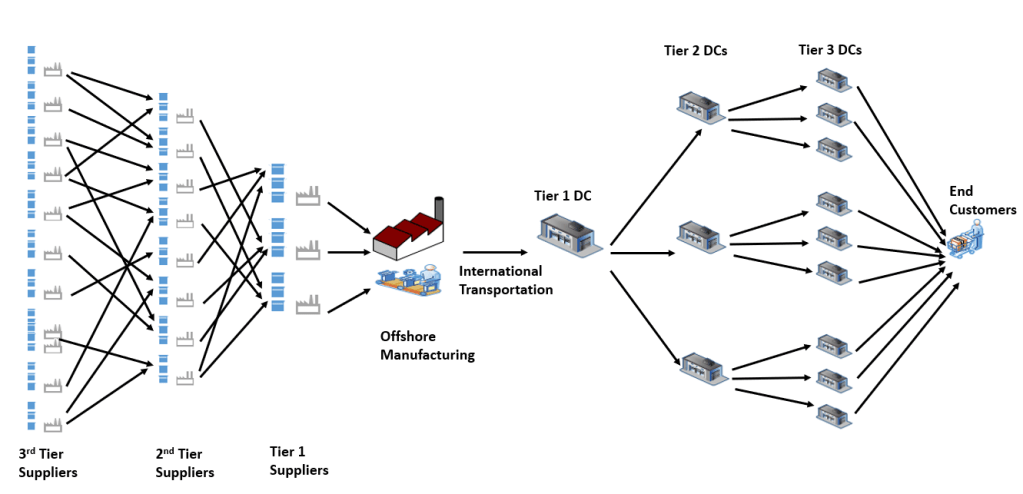

To understand, at a high level, how 3D Printing can disrupt or transform supply chain networks, we will use the network shown in the illustration below.

It shows a typical manufacturing and distribution supply chain network, with tiers of suppliers and multi-echelons of distribution networks.

Some high-level aspects of the network are shown in the illustration above:

(1) Multiple tiers of suppliers that supply to each other and the original equipment manufacturer (OEM). A significant amount of regional transportation happens in this stage.

(2) OEM or the contract manufacturer does the final assembly and ships the last group to the next node, typically a distribution center (DC). If done overseas, this leg of shipment is generally ocean or air.

(3) Once it reaches North America or Europe, the product is moved inland and then stored and distributed through multiple echelons of the distribution network.

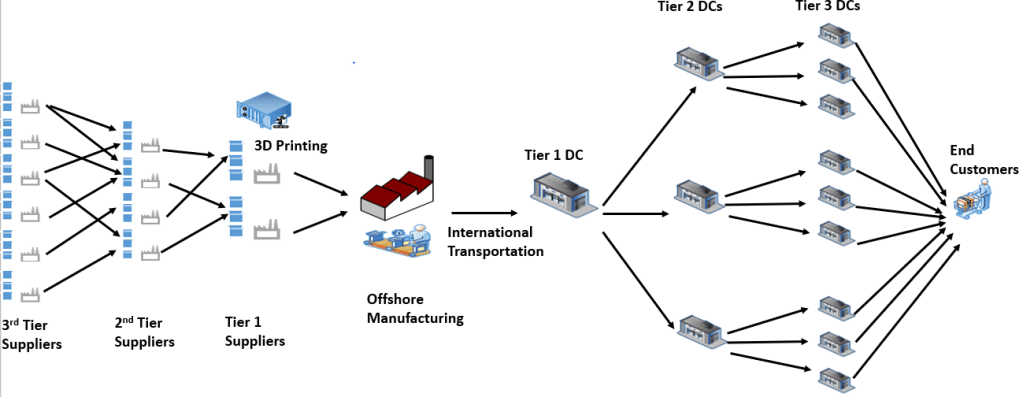

Phase One of 3D Printing Evolution

In phase 1, many of the existing semi-fabricated goods suppliers are replaced by 3D printing plants, as shown in the illustration below. Few key strategic suppliers will remain.

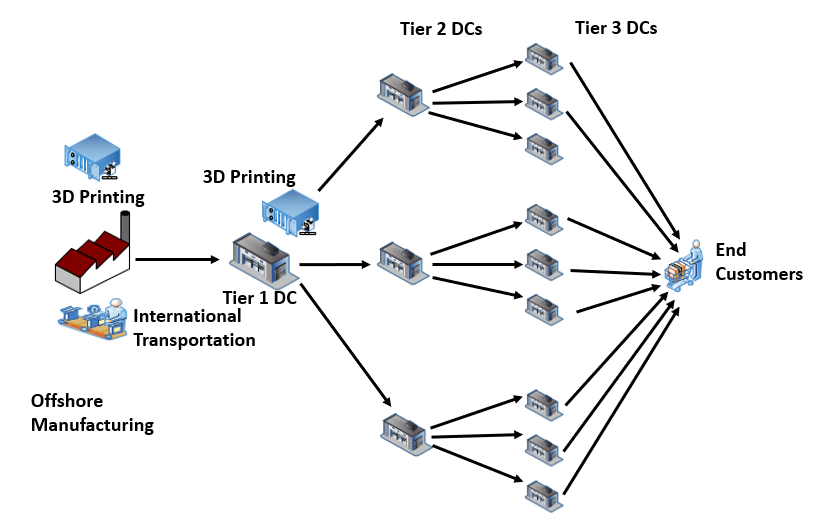

Phase Two of 3D Printing Evolution

In this phase, the assembly plant also incorporates the technology, thereby reducing a decent labor pool and most of the suppliers of the semi-fabricated goods.

Phase Three of 3D Printing Evolution

In this phase of evolution, the final assembly plant transforms into a kind of semi-finished goods assembly. Once the product reaches the last destination region, many primary DCs in these regions will double up as 3D printer plants for spare parts, using their proximity to the customer and service engineers to meet tight service level agreements.

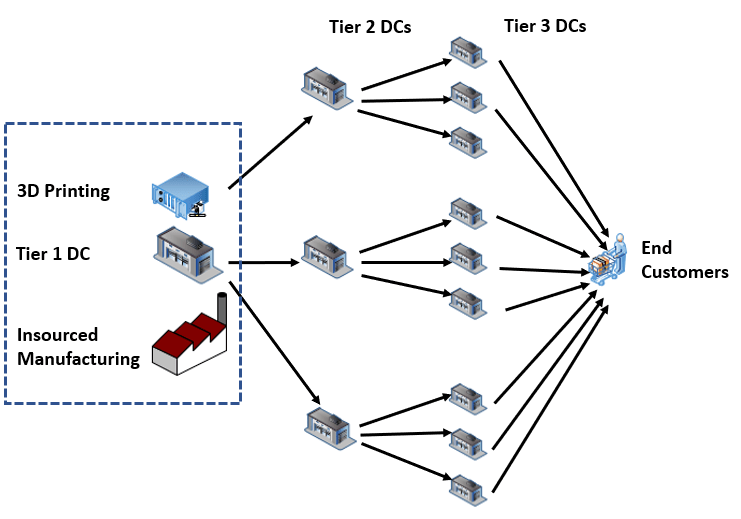

Phase Four – The Final phase of the 3D Printing evolution

Global manufacturers can exploit the technology to produce goods without large labor forces. Hence the low-cost countries will lose their competitive advantage as a manufacturing locations, and the production will be ‘re-shored.’

Raw materials will still be imported from other Global regions to 3D printing plants in Asia and Europe.

Challenges Ahead

Despite having the capacity to disrupt supply chains in a significant way, 3D printing has not been able to take off as expected due to the following reasons:

(1) Cost per part is still relatively high

(2) Talent pool with the right know-how is still limited

(3) There is a lack of enthusiasm for significant manufacturers to adopt the technology due to factors like fear of failures, regulatory burdens, concerns over intellectual property (IP), etc.

These issues need to be addressed for mass adoption of 3D Printing, which is becoming critical in this age of tariff wars, nationalism, and protectionism, and now Covid-19, to mitigate the risks associated with global manufacturing footprint.